A digital wallet is an electronic wallet that holds digital currency to buy goods and services.

To name a few: Venmo, Cash App, Zelle, Revolut, WeChat Pay, AliPay, Mercado, and Paypal. And here’s more from the Ark Funds research team.

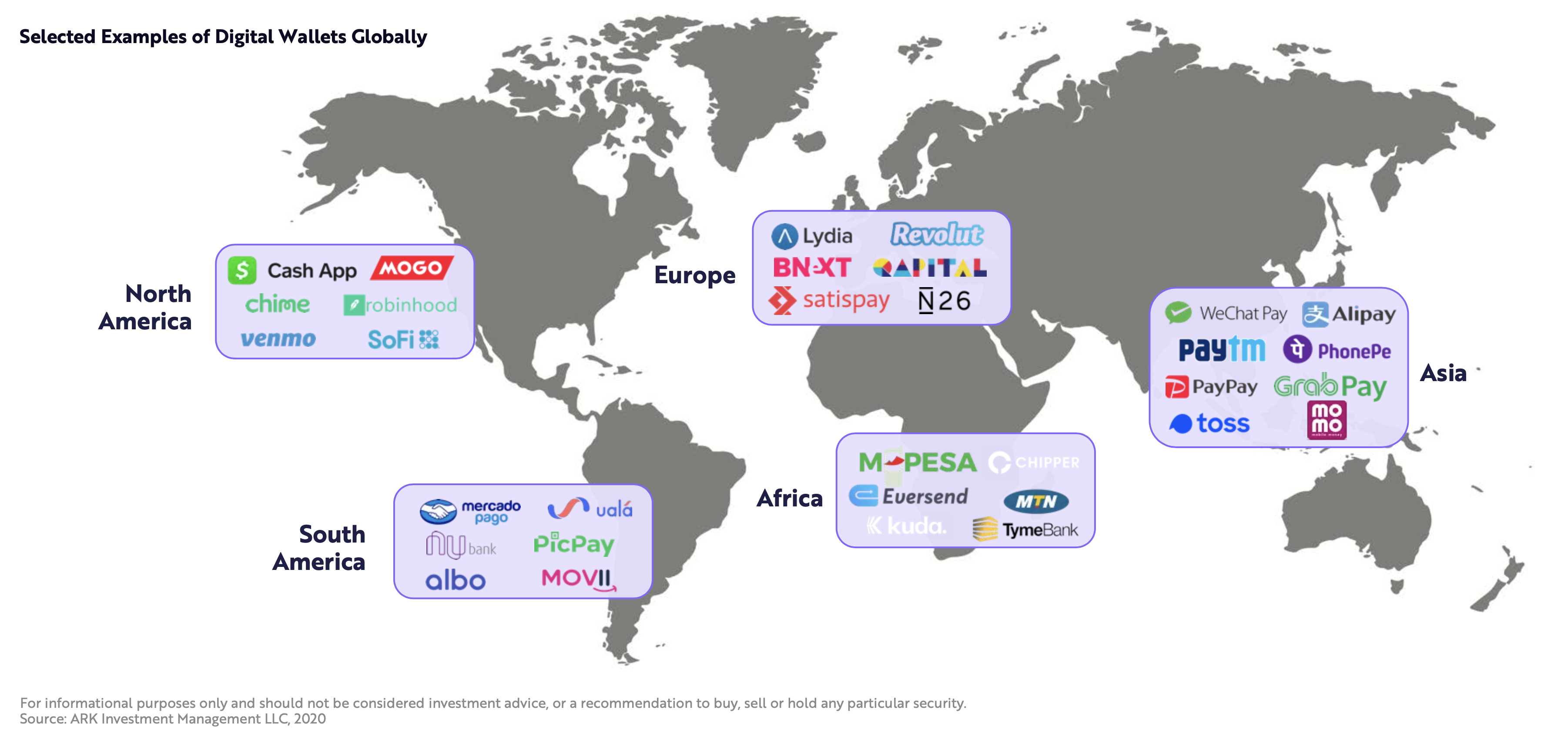

Global view of digital wallets

When COVID hit, digital wallets surpassed cash for the first time as the number on payment method at all points of sales globally. The most popular digital wallets are apps that live on your smartphone. And for the unbanked, it’s the only way to trade.

Big Numbers

According to Ark, today the average user spends up to $2,000 with their digital wallet. In 2025, scaling this to $20,000 per user represents a $4.6 trillion opportunity in the US. Digital wallets are set to disrupt traditional banking. Technology innovations in 5G, cloud, mobile phones, cybersecurity, and modern applications will bring digital wallets to the masses.

China is leading the way. Mobile payments stand at $36 trillion that is two and half times it’s GDP. Over the last decade in the US the Venmo and Cash App digital wallets have amassed 60 million active users. Compare that to JP Morgan that took 30 years and 5 acquisitions to achieve the same result. And then there’s the customer acquisition costs for traditional credit cards, bank accounts and brokerage accounts that are 75 times higher than that digital wallets at an estimated $20.

Diversity

Digital wallets will get smarter and as the products and services they manage and offer become more diverse. Digital currencies that are mix of fiat (USD, GBP, EUR, YEN, etc) and crypto (Bitcoin, Etherum, Polkadot, etc.) currencies. Superior interest rates offered due to the digital native, low cost advantage over traditional banks. In 2020, bank interest income on credit cards dropped 10% representing $16 billion off the tranditional bank’s bottom revenue line. And with digital wallets entering the unsecured lending marketing, will traditional banking recover.

Adoption

This is critical to the success of digital wallets and undoing of traditional banking. It’s happening. It’s a one way street. Once a customer uses a digital wallets, they don’t switch back. In fact, digital wallets are a launch pad to commercial activities far beyond financial products.